Heart disease is one of the most common causes of early death. Though it’s not always preventable, routine screenings and early intervention can help protect an individual and even minimize the risk of death.

Many people fail to realize they can and should obtain heart disease screenings. Depending on your age and history, it may be a good idea for you to work closely with your health insurance providers to make sure you have ample coverage for this type of protection.

Preventative Care Offers Protection

Most health insurance policies have a component called preventative care.

This element of your policy allows you to see your primary doctor for routine wellness care. For example, most plans allow patients to visit their doctor at least one time a year for a wellness checkup.

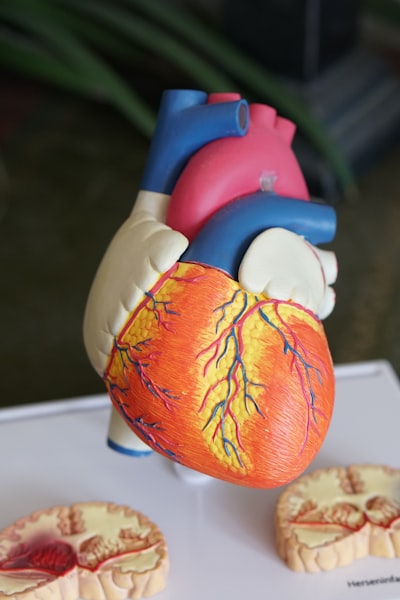

During this checkup, your doctor will take your blood pressure and listen to your heart. The doctor may also do routine blood tests. All of this can help to pinpoint any warning signs of heart disease. All you have to do is to go in to see your doctor for one of the checkups offered to you under your health insurance plan.

When Do You Need Additional Testing?

Most health insurance policies also provide for health screenings and diagnostic tests, when necessary. Your doctor may order additional testing in the following situations:

- Your heartbeat is not normal. Doctors can use an EKG as a noninvasive test to determine if you have an abnormal rhythm.

- Your heart has sounds of valve leaks or murmurs. Your doctor may hear these during your routine exam.

- You have symptoms of heart failure, such as a build-up of fluid or shortness of breath when walking. A noninvasive ECHO can tell doctors more about the condition of the heart’s structure.

- Your blood work shows high levels of cholesterol. This may indicate the need for a more invasive catheter to determine if there are blockages. It may also warrant medication.

- Your blood pressure is high. After determining the cause through more testing, your doctor may recommend medications.

Your health insurance provider is likely to cover some of these screenings and tests if your wellness exam picks up on the need for them. You may also need more invasive techniques, or even to see a cardiologist. By simply getting a wellness exam, you can find out if you’re at risk for heart disease.

We have the coverage you need. Call Driscoll & Driscoll Insurance Agency a free health insurance quote.